YEARS OF EXPERIENCE

I SERVIZI DI Target S.r.l.

New Life for Precious Metals

Are you an individual or a company in the precious metals sector? Are you looking for a professional evaluation for gold, silver, platinum, or palladium?

We are Target S.r.l. Metalli Preziosi and, thanks to our in-depth market knowledge, we offer tailor-made solutions:

Trust Target S.r.l. Metalli Preziosi for comprehensive, transparent, and professional support every step of the way.

SERVICES FOR INDIVIDUALS

SERVICES FOR OPERATORS

- Raffineria oro, Argento, Platino e Palladio

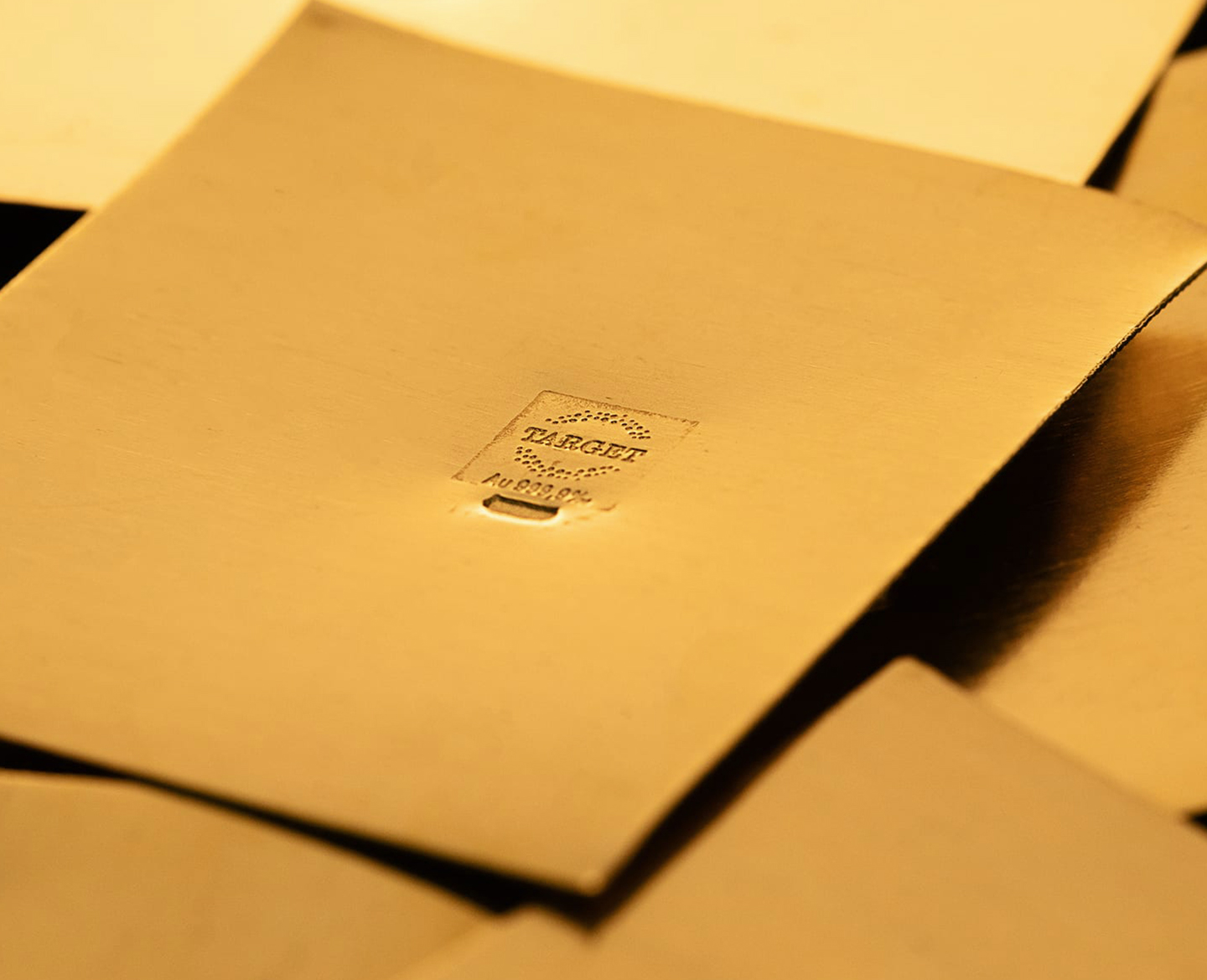

- Production of Investment Gold Bars

- Banco Metalli Preziosi in Milano

- Banco Metalli Preziosi in Alessandria

Services for Individuals

B2C SERVICES

Refinery

We buy used gold and silver items (coins, jewelry, bars, and pure gold) at the best price, with immediate and certified payment.

Investments

The safe and lasting solution that increases in value over time. We assist you in choosing and purchasing gold bars and coins, personalizing your investment plan.

EVALUATIONS

Our market knowledge is at the service of individuals. We offer consulting to help you start investing safely in gold and other precious metals.

MELTING

All melting operations are carried out with maximum transparency and professionalism. We handle every stage to give new life to your precious items.

TARGET METALLI

Your Partner in the Precious Metals Sector

Target S.r.l. Banco Metalli preziosi, with offices in Milan and Alessandria, supports goldsmiths, jewelry stores, and refiners with a comprehensive offering: guaranteed price lock-in, qualified collection, melting, and meticulous refining, as well as the trading of bars, coins, and precious metals.

Contact us to learn more about our services for precious metals market operators.

Contact us to discover our services dedicated to operators in the precious metals market.

Services for Operators

B2B SERVICES

MELTING

In our in-house laboratory, we manage professional melting of used precious metals to reintroduce them into the market with guaranteed quality.

ANALYSIS

Professional Gold Check: our qualified technician performs analyses on all precious metals to determine their composition and value.

REFINING

Our refining processes achieve extremely high levels of purity for gold and silver, suitable for any type of processing.

TRANSPORTATION

Fast and secure collection, transportation, and delivery of gold and precious metals throughout Italy, using value couriers with insurance coverage.

What to know about precious metals

What to know about precious metals

GUIDE TO GOLD

When it comes to precious metals

1. Stamping control Any object composed of a precious metal must bear at least two small stamps required by law: one bears the title of the precious metal present in the majority, the other a mark identifying the producer of the object (a star + a number + the initials of the producer's province) issued by the local Chamber of Commerce, Industry and Crafts.2. The carats of gold Below is a table of legal titles for gold objects produced and marketed in Italy: 24 kt = 999,9‰ 22 kt = 916,7‰ 18 kt = 750‰ 14 kt = 585‰ 10 kt = 417‰ 9 kt = 375‰ 8 kt = 333‰.3. Final caution By observing the previous two points, you can almost certainly save yourself from fraudulent attempts, in case of doubt Target S.r.l. will advise you, evaluate your items and make you the best offer to buy them

Effective strategies for investing in gold

1. Market study and timing On our site you can see the current updated gold price and a historical chart of its trend. From the graphs you can see that in the very short and short term the variation can be significant but in the long term the trend is always to rise. Target S.r.l. will never advise you to speculate, it is careful about preserving your capital. 2. Defining the capital to be invested Target S.r.l. advises you to invest no more than 30 percent of your available cash in pure gold, another 30 percent in bank securities or repos, and the remaining liquid in your checking account. Remember that at Target S.r.l. you can monetize your valuables quickly and with maximum transparency. 3. Support from a financial advisor If you have no experience in this area, rely on Target S.r.l.: its expertise will help you develop effective gold investment strategies and optimize returns.

What are investment coins

1. Investment coins: what are they? Investment coins are minted, from 1800 onward, in gold by the state mints of different countries and valued according to the weight and purity of the metal contained, not rarity or state of preservation. 2. What are numismatic coins? The value of numismatic coins depends on who and when they were minted in addition to rarity, mintage, and condition, not on the gold they contain. 3. Formats and purity Investment coins come in different sizes: normally 1 ounce, half ounce, quarter ounce or tenth ounce. Purity varies depending on the issuer, normally 900‰ and 916.7‰. 4. Major investment coins4.1 Krugerrand (South Africa) First gold investment coin (1970), contains 1 oz of pure 22 kt gold (916.7 ‰) and carries no face value, but is globally recognized. 4.2 American Eagle (USA) Official U.S. coin with face value of 50$ , combines authenticity of the U.S. Mint with 1 oz of pure 22 kt gold (916.7‰), a popular choice among international investors. 4.3 Maple Leaf (Canada) Minted by the Royal Canadian Mint, 1 oz of pure 24 kt gold (999.9‰), prized for purity, clean design and worldwide recognition. 4.4 Kangaroo (Australia) Also known as Nugget, issued by the Perth Mint in 1 oz of pure 24 kt gold (999.9‰), with variable annual design and controlled circulation to encourage collection. 4.5 Philharmonic (Austria) Gold Philharmonic, issued by Münze Österreich since 1989, 1 oz pure 24 kt gold (999.9‰) with euro face value, famous for musical details and wide liquidity. 4.6 Panda (China) Minted by the Shanghai Mint, offers 1 oz of pure 24 kt gold (999.9‰) with annual panda-centered design, combines investment and numismatic appeal. 4.7 Gold Sovereign (United Kingdom) 1/4 oz gold sterling, 22 kt (916.7‰) issued by the Royal Mint, valued for prestige and market stability. 4.8 Marengo (Italy) Historic Italian coin (issued 1861-1923), 1/4 oz pure gold 21.6 kt (900‰), ideal for those seeking to combine gold investment and national collector value.

Investing in gold: advantages and disadvantages

1. Protection from political uncertainties Gold is a recognized safe haven asset against inflation and currency fluctuations. In times of geopolitical instability, it retains its value better than traditional currencies and financial instruments. 2. Portfolio diversification Due to its low correlation with stocks and bonds, gold improves portfolio stability. Placing physical gold among investments reduces overall risk and protects against market crashes. 3. Preservation of value High value density allows large amounts of capital to be stored in small spaces. A small amount of gold in a safe deposit box is more practical than real estate or other commodities. 4. The Italian tax on precious metals Pure investment gold (bars and post-1800 gold coins) is not subject to Value Added Tax (IvA); worked gold (goldsmithing and jewelry), silver, platinum and palladium, in any form and purity is subject to IvA 22%. When you would like to sell pure gold investment bars or investment gold coins, pure silver, platinum and palladium, you will have to pay, in separate taxation and noting it on your tax return, a 26% tax calculated on the difference from the purchase invoice and the sales invoice or, if you do not keep the purchase invoice, 26% is calculated on the entire value of the sale. You should also know that, if by chance the proceeds of the sale turn out to be less than the purchase, the same 26% percentage can be taken as a deduction in your return (we recommend that you look into this case with your accountant). On the other hand, when you want to sell your used precious metals, you will not have to report any profit or loss to be taxed since the IRS assumes you have already collected IvA at the time of your purchase.

Metal bank vs. gold buyer: what differences

1. Introduction to the Metal Bank An alternative solution to Compro Oro for the sale of gold and precious jewelry is Target S.r.l.Metalli Preziosi, a private business licensed by the Bank of Italy that offers specialized services beyond just buying and selling. 2. Authorization and relevant law Target S.r.l., as a Professional Operator in Gold, was established under Law 7/2000, which introduced strict stakes to prevent risks of criminal infiltration. Only those who obtain registration with the Bank of Italy can engage in this activity. 3. Corporate requirements The activity must be carried out at least by a Limited Liability Company (S.r.l.) with share capital of not less than €50,000 (equivalent to that of an S.p.A.). 4. Corporate object Our articles of incorporation clearly state the buying and selling of pure precious metals. It can also buy used precious metals from individuals but cannot sell gold and jewelry items. Without this wording, it is not possible to apply for a license. 5. Honorability requirement According to Articles 16 and 108 of the Consolidated Law on Credit Law, all members and managers must be of good standing and run the business according to the "good family man rule." 6. Registration with the Chamber of Commerce, Industry and Handicrafts (CCIA). A Professional Operator must be registered in this official registry, with a registration number that is stamped on the pure precious metals it places for sale to ensure traceability along with the title of the precious metal. 7. Exclusive services of Target S.r.l. In addition to buying and selling gold, silver and other precious metals, the Metals Bank can: – carry out casting and refining of used precious metals; – make pure gold bars for investment; – collect and recycle unsold used gold from jewelry stores and Compro Oro; – our Offices are at your disposal to explain all our services, some exclusive.